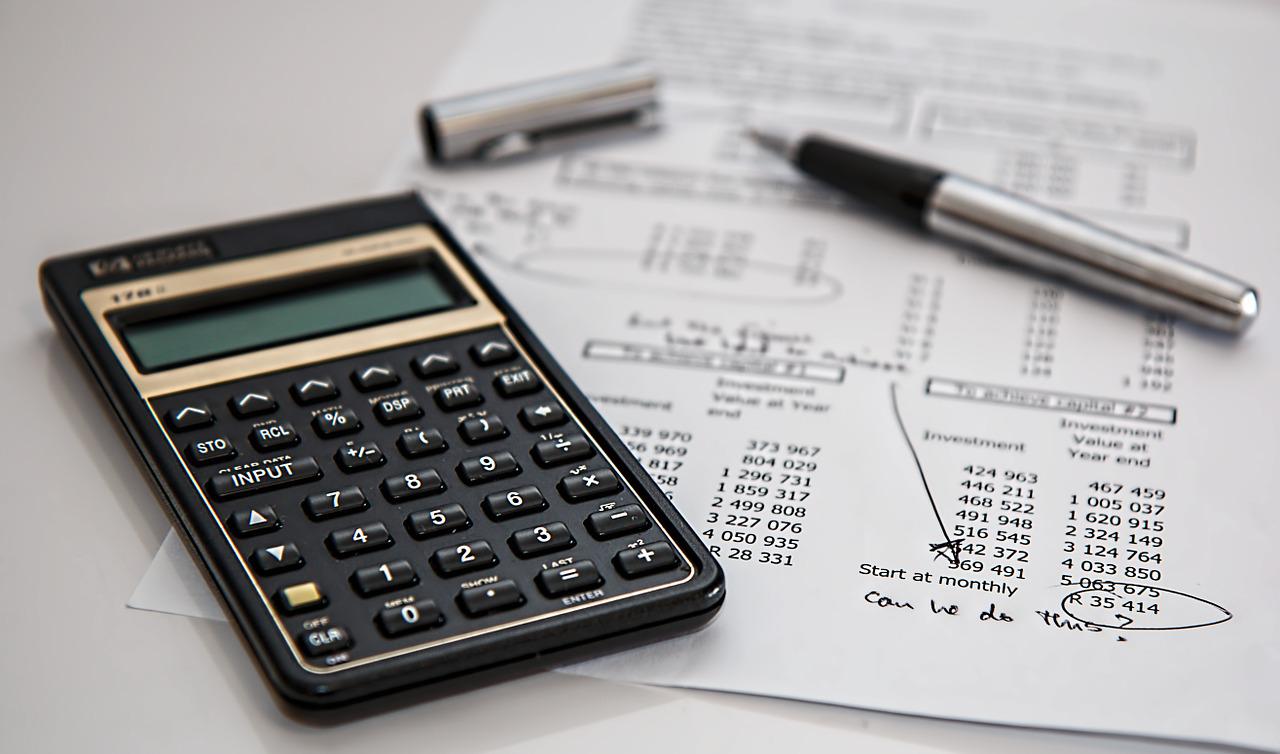

How to Effectively Manage Business Finances

As a business owner, it is essential to manage your finances. If you don’t have a solid understanding of financial concepts, you could find yourself in trouble quickly. In this blog post, we will discuss some tips for managing your business finances. We will cover budgeting, installing a POS system, and cash flow management. You can ensure that your business is running smoothly financially by following these tips.

Install a POS System

A POS system can help you keep track of your inventory and sales. Today, you can easily get one. Many people prefer to pay with a local german solution. Having a POS system is crucial when it comes to managing your finances. You can see where your money is coming in and going out by tracking your sales. This information can help you make better financial decisions for your business.

A POS system can help you keep track of your inventory and sales. Today, you can easily get one. Many people prefer to pay with a local german solution. Having a POS system is crucial when it comes to managing your finances. You can see where your money is coming in and going out by tracking your sales. This information can help you make better financial decisions for your business.

This is why many business owners choose to install a POS system. They have seen an increase in their profits and decreased financial problems.

Create a Budget

Creating a budget is another important so you can manage your finances. A budget will help you track your income and expenses to see where your money is going. It is also a good idea to review your budget regularly to make sure that it is still accurate. This is why creating a budget and reviewing it regularly is essential. This is so you will avoid financial problems in the future. Many people have found that creating a budget can save money and avoid financial problems for their business.

Manage Your Cash Flow

Cash flow is the lifeblood of any business. It is essential to keep track of your cash flow and to ensure that you have enough money coming in to cover your expenses. There are a few different ways to do this, but one of the most important is to create a budget, as mentioned above. By tracking your income and expenses, you can better understand where your money is going and how much you need to bring in each month.

Cash flow is the lifeblood of any business. It is essential to keep track of your cash flow and to ensure that you have enough money coming in to cover your expenses. There are a few different ways to do this, but one of the most important is to create a budget, as mentioned above. By tracking your income and expenses, you can better understand where your money is going and how much you need to bring in each month.

It will also make things easier for you when tax season comes around. By following these tips, you can better handle your business finances. By tracking your sales, creating a budget, and managing your cash flow, you can ensure that your business is running smoothly financially. These are just a few of the many things you can do …

It is always a good idea to know some bit of information to any individual or entity you are about to do business with. This gives you a clear idea on what you are walking into, what to expect or whether to engage the lender or not. You can talk to friends or family who have conducted business with the lender before and ask them what their experience was dealing with them. Alternatively, you can go online and look for independent reviews and feedback from borrowers. This information can enable you to make the right judgment on whether the lender is the suitable one.

It is always a good idea to know some bit of information to any individual or entity you are about to do business with. This gives you a clear idea on what you are walking into, what to expect or whether to engage the lender or not. You can talk to friends or family who have conducted business with the lender before and ask them what their experience was dealing with them. Alternatively, you can go online and look for independent reviews and feedback from borrowers. This information can enable you to make the right judgment on whether the lender is the suitable one.